By manoj August 5, 2024

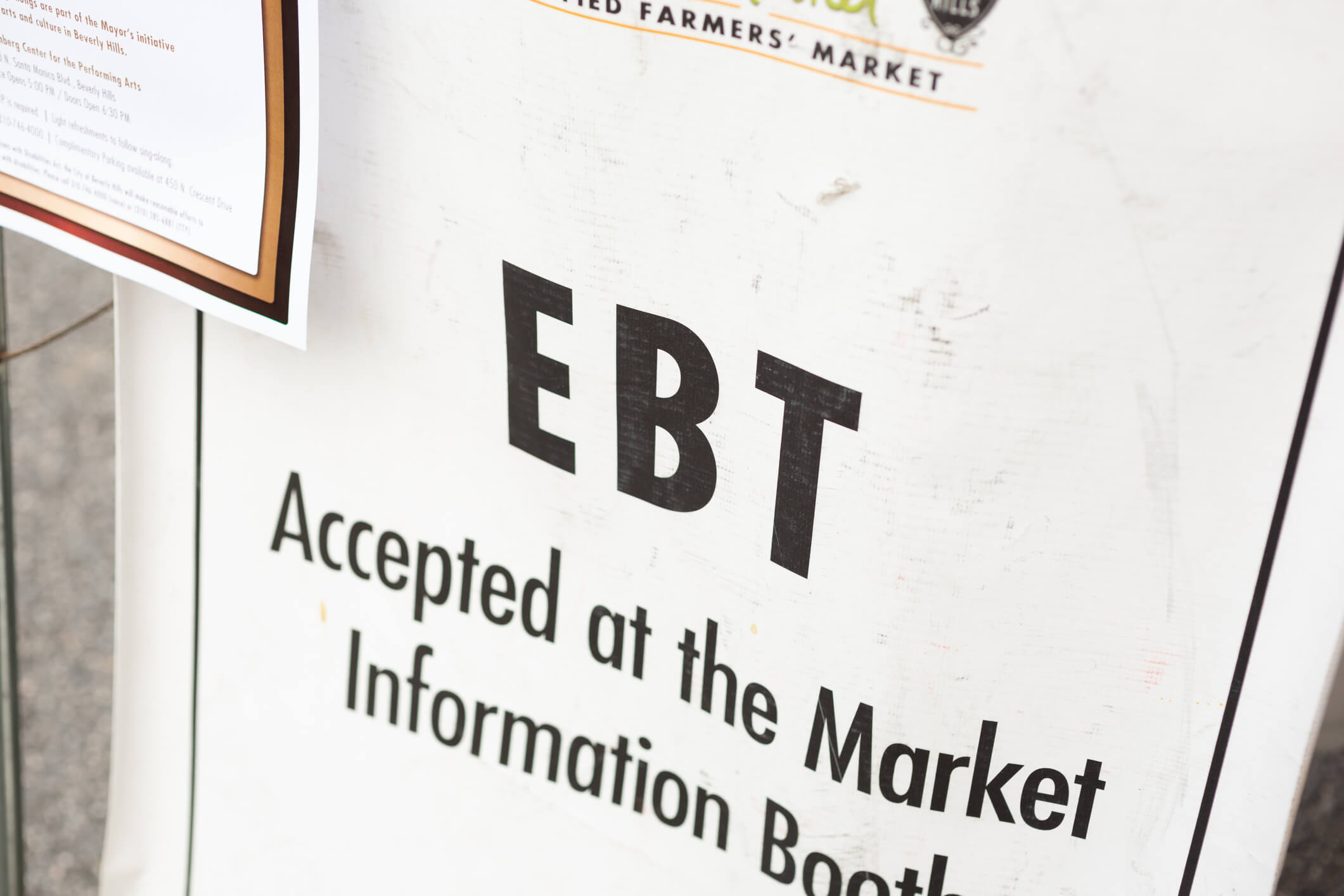

Electronic Benefit Transfer (EBT) payment processing is a system that allows government programs to distribute benefits electronically to eligible individuals. It has revolutionized the way government assistance programs operate, providing a more efficient and secure method of delivering benefits.

In this article, we will explore the various aspects of EBT payment processing, including how it works, its benefits, key players and stakeholders, security measures, common challenges and solutions, best practices and compliance, and frequently asked questions.

Understanding Electronic Benefit Transfer (EBT)

Electronic Benefit Transfer (EBT) is a system that enables the electronic distribution of government benefits to eligible individuals. It replaces traditional paper-based methods, such as food stamps and paper checks, with a more convenient and secure electronic system. EBT cards, similar to debit cards, are issued to eligible individuals, who can use them to access their benefits at authorized retailers and ATMs.

EBT Payment Processing Works

EBT payment processing works through a network of electronic systems that facilitate the transfer of benefits from government agencies to recipients. When a person is approved for benefits, they are issued an EBT card, which is linked to their account. The card contains a magnetic stripe or a chip that stores the recipient’s information.

When a recipient wants to access their benefits, they can use their EBT card at authorized retailers or ATMs. The card is swiped or inserted into a card reader, and the recipient enters their Personal Identification Number (PIN) to authenticate the transaction. The retailer’s point-of-sale system or the ATM then communicates with the EBT payment processing network to verify the recipient’s eligibility and the availability of funds.

Once the transaction is approved, the recipient’s account is debited, and the retailer or ATM is credited with the corresponding amount. The funds are transferred electronically from the government agency’s account to the retailer’s or ATM operator’s account.

Benefits of EBT Payment Processing for Government Programs

EBT payment processing offers numerous benefits for government programs and recipients alike. Firstly, it eliminates the need for paper-based methods, reducing administrative costs and the risk of fraud. With EBT, there is no need to print and distribute paper checks or food stamps, saving time and resources.

Secondly, EBT provides recipients with a more convenient and dignified way to access their benefits. They can use their EBT cards at authorized retailers, just like any other debit card, without the stigma associated with traditional paper-based methods.

EBT payment processing also improves the accuracy and timeliness of benefit distribution. The electronic system ensures that benefits are delivered promptly and accurately, reducing errors and delays. This is particularly important for vulnerable populations who rely on government assistance for their basic needs.

Furthermore, EBT payment processing allows for better tracking and reporting of benefit usage. Government agencies can monitor and analyze data on how benefits are being used, enabling them to make informed decisions and improve program efficiency.

EBT Payment Processing: Key Players and Stakeholders

Several key players and stakeholders are involved in the EBT payment processing ecosystem. At the core are the government agencies responsible for administering the benefit programs. These agencies work with payment processors, such as banks or third-party processors, to facilitate the electronic transfer of funds.

Retailers and ATM operators are also important stakeholders in the EBT payment processing system. They must be authorized by the government agency to accept EBT payments and comply with the necessary regulations and requirements.

Additionally, technology providers play a crucial role in developing and maintaining the EBT payment processing infrastructure. They provide the hardware, software, and network systems that enable the secure and efficient transfer of funds.

Security Measures in EBT Payment Processing

Security is a top priority in EBT payment processing to protect the integrity of the system and the funds involved. Several security measures are in place to ensure the confidentiality, integrity, and availability of data.

Encryption is used to secure the transmission of data between the EBT card, the point-of-sale system, and the EBT payment processing network. This ensures that sensitive information, such as the recipient’s account details and PIN, cannot be intercepted or tampered with.

Authentication mechanisms, such as PINs, are used to verify the identity of the recipient during transactions. The PIN is known only to the recipient and serves as a unique identifier to prevent unauthorized access to the benefits.

Monitoring and auditing tools are employed to detect and prevent fraudulent activities. Suspicious transactions or patterns are flagged for further investigation, and appropriate action is taken to mitigate risks.

Regular security assessments and audits are conducted to identify vulnerabilities and ensure compliance with industry standards and regulations. This helps to maintain the integrity of the EBT payment processing system and protect against emerging threats.

Common Challenges and Solutions in EBT Payment Processing

While EBT payment processing offers numerous benefits, it also presents certain challenges that need to be addressed. One common challenge is the potential for fraud and abuse. Fraudsters may attempt to exploit vulnerabilities in the system to obtain benefits they are not entitled to. To combat this, robust security measures, such as encryption, authentication, and monitoring, are implemented.

Another challenge is ensuring accessibility for all recipients, including those with disabilities or limited access to technology. Efforts are made to provide alternative methods of accessing benefits, such as toll-free phone lines or in-person assistance, to accommodate individuals who may face barriers in using electronic systems.

Technical issues, such as system outages or connectivity problems, can also pose challenges in EBT payment processing. Redundancy and backup systems are put in place to minimize disruptions and ensure continuous access to benefits.

EBT Payment Processing: Best Practices and Compliance

To ensure the smooth operation of EBT payment processing, it is essential to follow best practices and comply with relevant regulations and standards. Government agencies and payment processors should establish clear policies and procedures for the issuance, usage, and monitoring of EBT cards.

Regular training and education programs should be provided to recipients, retailers, and ATM operators to ensure they understand their roles and responsibilities in the EBT payment processing system. This helps to prevent errors and fraud and promotes compliance with program rules and regulations.

Furthermore, ongoing monitoring and evaluation of the EBT payment processing system are necessary to identify areas for improvement and address emerging challenges. Collaboration between government agencies, payment processors, retailers, and technology providers is crucial to maintain the effectiveness and integrity of the system.

Frequently Asked Questions (FAQs) about EBT Payment Processing

Q.1: What is the difference between EBT and SNAP?

EBT refers to the electronic system used to distribute government benefits, while SNAP (Supplemental Nutrition Assistance Program) is a specific government assistance program that provides eligible individuals with funds to purchase food.

Q.2: Can EBT cards be used for non-food items?

EBT cards can only be used to purchase eligible food items, as specified by the government assistance program. Non-food items, such as household supplies or clothing, cannot be purchased with EBT benefits.

Q.3: Can EBT benefits be used online?

Some states allow EBT benefits to be used for online purchases through approved retailers. However, not all states have implemented this option, so it is important to check with the relevant government agency for specific guidelines.

Q.4: What should I do if my EBT card is lost or stolen?

If your EBT card is lost or stolen, you should immediately contact the government agency responsible for administering the benefit program. They will deactivate the lost card and issue a replacement.

Q.5: Can EBT benefits be transferred to another person?

EBT benefits are non-transferable and can only be used by the eligible recipient. It is illegal to sell or trade EBT benefits.

Conclusion

EBT payment processing has revolutionized the way government assistance programs distribute benefits to eligible individuals. It offers numerous benefits, including cost savings, convenience, accuracy, and improved tracking and reporting. However, it also presents challenges, such as fraud and accessibility issues, which need to be addressed through robust security measures, best practices, and compliance with regulations.

By understanding the intricacies of EBT payment processing and implementing effective strategies, government agencies can ensure the efficient and secure delivery of benefits to those in need.